How it Works

Let's walk you through the basic process

1. Create your membership account (free to start, with valuable extras for subscribers)

2. Create your plan, choosing a single region or multi-region for expats, explorers, and dreamers. It’s easy

3. Fill in your plan with pertinent details

- We’ll guide you through this, and you can take your time adding & updating things over time to account for changes in your life, things you forgot, or new members (or pets) in the household

- Include the Assets, Liabilities, and Income Sources that you have now; or plan to have in the future such as age-based benefits. We’ll help get you started with a quick-pick lists of things common to many pepople based on your country or the country you plan to retire in

4. Refine details relating to fees, taxes, adjustors, etc. Again, we’ll help with this

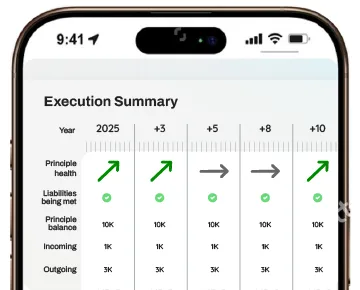

5. Subscribers can review Deep Dives to find blind-spots, risks, or better understand how your choices; or changes in your economy; may impact the longevity of your plan

6. Over the year we’ll analyse subscriber plans and send you reminders of things you may want to consider. These are not upsells, just potential blind-spots that you can use to adjust your plan (Ex. You own your home, but you may not have planned for the cost of periodic roof replacemants, etc.)

Things you won’t need

- We will never ask you for details on your identity; although subscribers will have to provide payment details

- We will never ask you for your financial account details so don’t enter account numbers or anything else you feel should be kept private

Frequently Asked Questions

Is Pinch & Prosper a budgeting app?

We offer a self-help financial planning tool that assists you in closing the gaps in your financial and retirement plans. No spreadsheets, no panic or pressure. No spiritual financial gurus to trick or confuse you. We’ll shine a light on key details and concerns so you can decide how to handle things in the future

Do I need to link my bank accounts?

No, and we don’t recommend connecting your financial accounts to any service. While it may save a little time, it’s not worth the risk. Keep your records safe and secure

What if I live in more than one country?

We’ve got you covered. We have options to create plans stretching across multiple regions and currencies. Work, save, and invest in one region and retire in another…

Can I share my plan with others?

Whether it is your Family, Accountant, or Professional Financial Advisor, you can securely share your plan as needed and revoke access at any time

Can I include other people in my Plan?

Yes, you can mark any detail as belonging to yourself, your spouse, a dependent, or even your pets. You can also create completely separate plans if you need to help someone else in your family

How many of my details are required?

The more you put into your plan the more realistic the results will be. We encourage members to take the time to add as many of the incoming and outgoing financial and benefit concerns as they have (or can predict). With that said… We do not need any personal details about your identity and there is no need to supply information on your personal financial accounts, keep those details safe

Do I need a professional Financial Advisor?

The legal and practical definition of a ‘Financial Advisor’ varies widely from country to country so make sure you have a clear view of the term as you navigate the topic. Depending on the complexity of your situation; if you feel like you cannot handle your own Plans; you might want to find Professional assistance. Regardless, you’ll still need to gather your details and become informed on key topics and concerns so you can ensure your Plans are handled reasonably. We can help you get started and then you can Invite a Professional advisor into your Plan

Stop Delaying. Start Preparing

Lets be honest. Most retirement planning tools feel like a punishment. They’re either build for finance pros, or designed to confuse you into buying something. It’s not wonder you’ve been putting it off. Most people have. Even us a few years ago, and the fact that all the tools for financial planning we tried didn’t help.

Don’t leave future-you underwhelmed with your current effort levels. Get started today. You’ll thank yourself tomorrow.